It’s time to get very excited about boring AI

Given the recent hype surrounding Generative AI, CFOs could be forgiven for believing that this is

the only AI technology they will ever need to consider. Whilst extracting information from

documents may not be the ‘flashiest’ application of AI technology, processing documents accurately

is a deeply etched and critical component of any finance function.

Thanks to a new generation of cloud based, AI infused, data extract platforms, finance staff no

longer need to spend half their day copying data from finance documents into finance applications 1 .

This saves businesses a lot of time and money 2 and frees finance staff to work on more valuable

tasks.

What are cloud based data extraction platforms?

Cloud based data extraction platforms enable non-technical business users to automate the process

of extracting data from PDFs, Word, scanned or image-based documents. They possess user-friendly

interface and advanced data parsing features, which makes it easy for finance functions to

streamline their document processing workflows and eliminate time consuming, manual data entry.

For example, finance functions can rapidly capture data from invoices, purchase orders, bank

statement, tax forms and other financial documents and then automatically transfer that data into

applications such as a CRM system, accounting software, Google Sheets or other ERP platforms.

What do cloud based data extraction platforms help finance functions do?

Gathering financial data to track money, is a time-consuming and manual process. Finance functions

often need to deal with large volumes of documents, such as invoices, receipts, statements, or

purchase orders. As a result, many finance professionals spend hours every day typing data from

documents into applications before they can complete their financial planning, book-keeping,

auditing, budgeting, or reporting. All of this, can slow down decision-making processes.

Thanks to inexpensive cloud-based data extraction platform, the era of copying data between

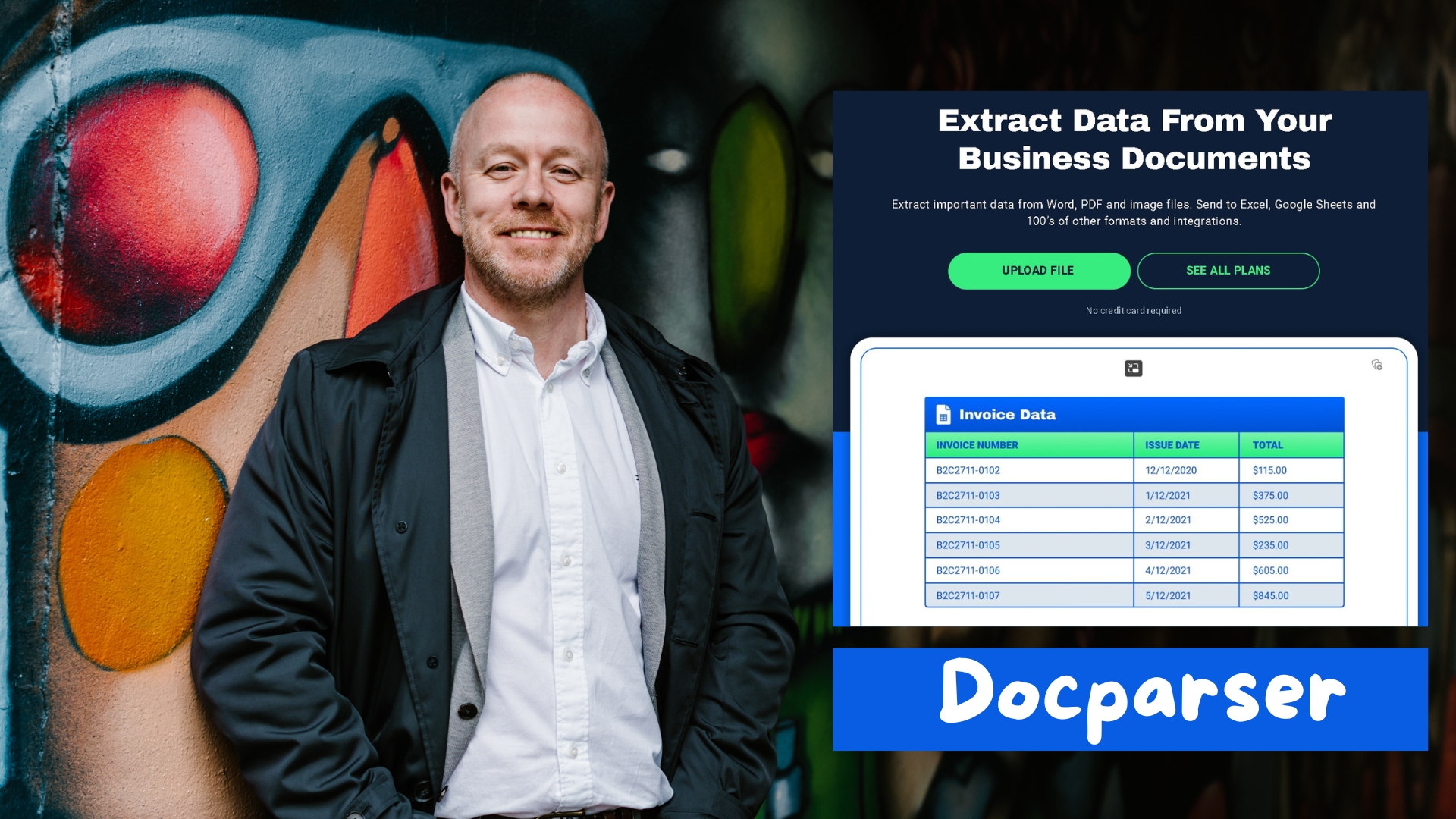

documents and finance systems is long gone. For example, as you see in the below example,

Docparser – a powerful cloud-based data extraction platform – provides an easy-to-follow point and

click system, that can be used by non-technical staff to identify and grab data from common finance

documents.

Figure 1: Docparser’s Pre-Built Data Extraction Templates

Alternatively, if finance personnel need to ingest data from a non-standard financial document, they can use Docparser’s Zonal OCR to quickly capture specific data tailored to their specific document use-case.

Docparser Zonal OCR enables non-technical business users to select specific data fields.

Finance staff no longer need to worry about each supplier having their own quirks as Docparser also takes care of that. For example, if required, bar codes and QR-codes can also be detected.

In addition, tables of data can be intelligently copied from financial documents and passed into an ERP package, a spreadsheet or any other finance application of choice.

Figure 3: Custom parsing rules can select tabular data.

If data downloads are required, then there are multiple download file formats available as well (e.g., CSV, Excel, JSON and XML files).

What does this mean for CFOs and their finance functions?

Cloud based data extraction platforms offer businesses multiple benefits.

- They are quick to learn and secure. For example, Docparser uses bank-level encryption, the latest web security standards, and limits the amount of time documents are retained on its secure servers, in order to protect your data.

- Everyone in the business can now be empowered with the ability to scan finance documents in minutes using simple point and click methods. Docparser does not require finance staff to have ‘coding skills’. It is an uncomplicated application that can be learned in no time at all by non-IT staff.

- Time can be reinvested in more valuable, complex or strategic work such as financial analysis or business partnering which can lead to significant operational gains.

- Document ingestion costs a lot of money. For example, if a midsized company that processes 100,000 pages of documents annually at three minutes per page, it would take approximately 5,000 person-hours to complete the task; at US$50 per hour, that’s $250,000. That money can now be saved.

- Docparser offers excellent direct integrations with Google Spreadsheets, Google Drive Box, Salesforce CRM, OneDrive, Excel and Box. It also connects to thousands of other cloud-based services and ‘low-code / no-code platforms that permits non-programmers to connect services and automate business processed including Zapier, Workato, MS Power Automate and more.

These benefits help finance functions streamline and automate their workflows, improve data quality, reliability, and availability, and enhance their decision-making capabilities.

Are there any risks to using Docparser document scanning application?

There are countless benefits to using data scanning software applications but there are also risks. For example, Docparser relies on OCR, ICR, and other technologies to extract data from documents. This may not always be 100% accurate or reliable, as some documents may have poor quality, complex layouts, or handwritten text that can affect the data extraction process.

That said, Docparser has thought of that. It provides data validation features to check and correct the data it is processing. For example, where low quality pdf documents require human intervention, finance professionals can be alerted and intervene to validate data as required.

Even though the platform is largely ‘point and click’ some business users may still find they lack the time to learn the Docparser application. Again, Docparser has also thought of that too. Businesses can pay the Docparser team to build data extraction workflows for them.

A vision for a data driven finance function

At some point, all invoices may become digital. Until then, finance departments need practical solutions to extract data from both paper and digital invoices in order to save money and time. Finance data collection, extraction, and analysis are critical to any business’s success. It can help attract new customers, retain existing ones, and save the business time and resources.

Thanks to cloud-based data extraction platforms any finance function, in any industry can automatically scan financial documents, capture data, validate it for accuracy and then automatically transfer it to other finance applications. This enables finance staff to make better, faster business decisions, that can lead to significant efficiency and cost reductions, tangible ROI and strategic gains. And those are the things that excite every CFO.

Resources

- https://www.pwc.com/gx/en/issues/data-and-analytics/artificial-intelligence/publications/ai-automation-data-extraction.html

- https://www.pwc.com/gx/en/issues/data-and-analytics/artificial-intelligence/publications/ai-automation-data-extraction.html

- https://www.pwc.com/gx/en/issues/data-and-analytics/artificial-intelligence/publications/ai-automation-data-extraction.html

- https://www.forbes.com/sites/forbestechcouncil/2021/07/28/mastering-the-art-of-extracting-data-from-invoices-using-ai-and-ml

- https://www.forbes.com/sites/forbestechcouncil/2021/07/28/mastering-the-art-of-extracting-data-from-invoices-using-ai-and-ml

- https://www.pwc.com/gx/en/issues/data-and-analytics/artificial-intelligence/publications/ai-automation-data-extraction.html

Comments (3)

Have a read of my article on this as well; https://kierangilmurray.com/its-time-to-get-very-excited-about-boring-ai/

[…] It’s time to get very excited about boring AI – Kieran Gilmurray […]

[…] 📕 It’s time to get very excited about boring AI – Kieran Gilmurray […]